Wall Street, Not Shanghai, Takes Hardest Hit over US Banning China’s IPOs

The US fortunes are fading and their ‘decoupling’ strategy will only accelerate the downward spiral of the nation.

Washington keeps moving forward on its China “decoupling” strategy but that could boomerang into disaster for the long-term health of the United States economy. US President Joe Biden has vowed to continue on with his predecessor Trump’s “America First” policies by taking a tough stand on Beijing.

Meanwhile, the US Securities & Exchange Commission (SEC) has ramped up tensions by enforcing tougher requirements for Chinese enterprises to get listed publicly in US-based stock exchanges. Consequently, no Chinese companies since late last month have formally submitted Initial Public Offerings (IPOs) applications.

The US stands the risk of losing out while Chinese companies will likely launch IPOs in the Shanghai, Hong Kong and Shenzhen stock exchange in the near future. Wall Street banks, financial advisory firms and investment banks will witness China’s listed companies in the US fleeing the New York Stock Exchange and NASDAQ and re-listing their shares at stock exchanges in China and elsewhere in Asia and Europe.

Washington’s gamble could have a devastating blow in New York, the world’s financial capital. According to data from the US-China Economic and Security Review Commission, as of May 5, 248 Chinese companies were listed in the US with total market capitalization estimated at $2.1 trillion.

Taking a tumble

Last December, the US enacted the “Holding Foreign Companies Accountable Act” which by law demanded foreign companies to strictly adhere to US securities laws. Chinese companies were specifically targeted and they are required to be audited and to disclose their data to the SEC. They must also reveal if they are owned or operated by foreign governments.

The Chinese government has expressed concerns over the data disclosures, which could place their companies at risk of espionage while the US government and US-based Big Data firms could gain unfair access to personal data on Chinese citizens. Beijing’s response sounds reasonable considering how the US federal government agencies — FBI (Federal Bureau of Investigations), CIA (Central Intelligence Agency) and NSA (National Security Administration) have earned notoriety for collecting data on individuals in efforts to conduct criminal investigations and covert spying operations that put innocent people at risk.

SEC Chairman Gary Gensler starting last month has ordered his staff to “engage in targeted additional review for companies with significant China-based operations,” according to Reuters. Chinese firms are required to provide supplementary risk disclosures and until then they can’t raise funds in the US until they provide detailed explanations about their legal structure and potential risk factors to include whether or not the Chinese government meddles in their business operations.

Coming back to China

Washington may think they have the upper hand, but Beijing and Chinese securities regulators are not panicking. They realize the end results will be Chinese companies returning to their homeland to seek new financing, public listings and investments while Wall Street gets left out in the cold.

“If the US regulator indeed suspends the Chinese IPOs it will be a big setback for US capital markets,” Dong Dengxin, director of the Finance & Securities Institute at Wuhan University, told the Global Times. “Meaning they will no longer live up to the name of an international free market without Chinese participation.”

“(The) HKEX has been well prepared for mainland IPOs second-listings,” Dong added. “Now it is able to rival the US market in terms of raising foreign investment, providing financial convenience and making international business connections, whereas the latter has become a political tool.”

Beijing has estimated that more Chinese companies could choose to de-list from US stock exchanges and transition back to China and Asia. Hong Kong will be a prime location, since capital flows and currency exchanges are easily accessible and convenient for foreign investors. Additionally, second-listings are viable option for Chinese companies as they realize de-listing from the US can be challenging.

“It is too costly and time-consuming for us to directly quit the US market, so a more likely choice is to hedge with a second listing in Hong Kong, whose Class A ordinary shares are convertible with American depositary shares on the US stock exchanges,” the executive said, describing the second listing as a transitional strategy and a “way out” as reported by the Global Times.

Aiming for Shanghai

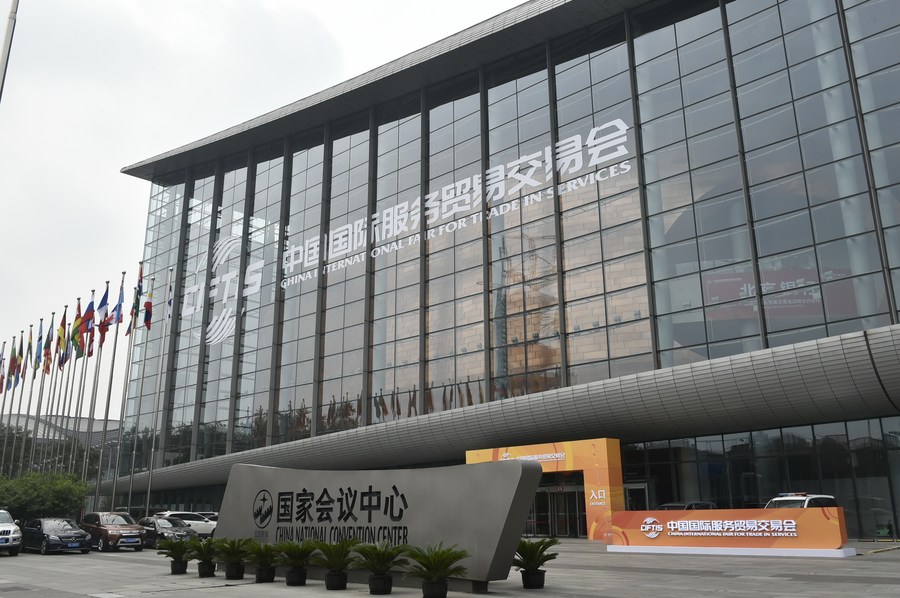

Hong Kong will not stand alone as the beneficiary of Chinese firms re-listing outside the US. Shanghai’s star is expected to shine brighter as Beijing has implemented new reforms to boost the nation’s financial markets and Shanghai will reap the rewards. China Telecom, one of the three big telecom operators in the country, announced its intentions to launch an IPO at the Shanghai Stock Exchange.

Starting on August 16, the company has started taking subscriptions for listing in Shanghai. That’s setting the stage for the world’s largest IPO this year. The company was unceremoniously de-listed from the NYSE (New York Stock Exchange) on account of the new US regulations. China Mobile and China Unicom were also de-listed from US stock exchanges. China Telecom had gone public on the NYSE in 2002.

China Telecom hopes to return to the A-share market of the Shanghai Stock Exchange by tapping into the ‘deep pockets’ of Chinese investors and improved capital infrastructure, as reported by the Global Times. The company wants to raise 47.1 billion yuan ($7.3bn) as disclosed by its filing with the Shanghai Stock Exchange. The shares at the expected opening are priced at 4.53 yuan and if the over-allotment option gets exercised, the Shanghai IPO could generate more than 54 billion yuan.

Last May, China Mobile announced plans to enter the Shanghai Stock Exchange. The nation’s leading telecom operator plans to issue up to 964.8 million shares in the A-shares market.

Shanghai could soon become Asia’s finance capital while New York will see less Chinese money flowing into Wall Street. Shanghai will welcome more IPOs and that will generate greater prosperity for the city and China overall. China Telecom sees the new international trend emerging and seeking to cash in on Shanghai’s rising fortunes.

Wall Street gloom

There’s an old saying, “cut the nose to spite the face,” meaning that somebody is willing to harm themselves in order to hurt others but they look foolish in doing so. Washington’s restrictions on Beijing has reared its ugly head and they had begun to shoot themselves in the foot but thinking China is the one getting hit.

Wall Street is the financial backbone of the US economy while Chinese companies listing in US-based stock exchanges have filled the coffers of New York’s banks and financial firms. But the rush of easy China money will start to fade as Chinese firms see they are no longer welcome in the US markets.

Shanghai, Hong Kong and Shenzhen will seize the day by encouraging more IPOs to get launched in their respective stock exchanges. Wall Street’s loss will be Shanghai’s gain. But the Biden administration does not seem to care.

The US fortunes are fading and their ‘decoupling’ strategy will only accelerate the downward spiral of the nation. China by default would be the winner.

The article reflects the author’s opinions, and not necessarily the views of China Focus.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +