China’s H1 GDP Shows Confidence to Face Challenges

It is wrong for Trump to believe that the imposed tariffs on China will be paid by China and that American consumers will not be affected.

The National Bureau of Statistics released on?July?15 China economic data for H1, 2019. Its GDP?grew by 6.3 percent year-on-year, of which the first quarter and the second increased by 6.4 percent and 6.2 percent year-on-year respectively.

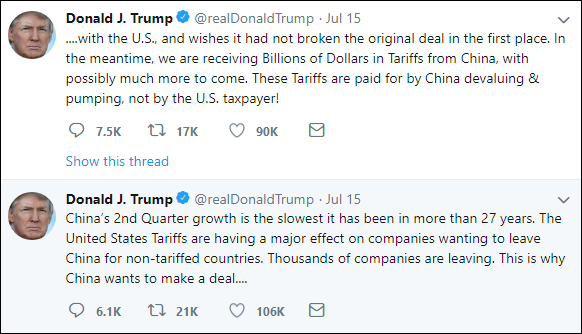

In this regard, Trump mocked China’s economy on his Twitter: “China’s 2nd Quarter growth is the slowest it has been in more than 27 years. The United States Tariffs are having a major effect on companies wanting to leave China for non-tariffed countries. This is why China wants to make a deal with the U.S.” “These Tariffs are paid for by China, not by the U.S. taxpayer!”

Sino-U.S. Trade Disputes Are Not the Cause of China’s Economic Slowdown

The slowdown of China’s economic growth occurred long before the Sino-U.S. trade frictions. The slowdown is the result of China’s initiative to adjust its economic structure in order to achieve high-quality economic development.

As we all know, Sino-U.S. trade frictions began in March 2018. Trump signed a trade memorandum to China to impose tariffs on $60 billion dollars of imports from China and to restrict Chinese enterprises’ investments in the U.S. and mergers?in the U.S.?Then, China was forced to take counter-action. With the escalation of trade frictions, the two sides have launched many rounds of negotiations, but an agreement has yet to be reached.

Prior to this, especially since the international financial crisis, China’s economic growth has gradually slowed. The purpose of economic deceleration is to strive for precious time and ample space to improve the quality and efficiency of the economy and achieve long-term sustainable and healthy development. Economic deceleration is the result of China’s initiative to adjust its economic structure given the structural reform on the supply side and to promote industrial transformation and upgrading. The Sino-U.S. trade disputes superimposed during the period of China’s economic restructuring have surely had a negative impact on China’s economic growth in the short term, but they are by no means the leading factors contributing to China’s economic slowdown.

U.S. Should Focus on its Own Economy

China’s economic growth is still at the world’s forefront. Despite the slowdown in China’s economy, the GDP growth rate of 6.3 percent is absolutely among the highest in both emerging and developing countries and developed economies.

In fact, within the context of a global economic growth slowdown and the increase of external uncertainties and instability factors, the economic growth of all countries in the world is generally under pressure. As a result, the economic growth of most of these countries is unsatisfactory.

The European Union’s GDP grew by 1.5 percent in the first quarter, while Germany, known as the “engine” of the European economy, grew by only 0.7 percent. Japan’s GDP grew by 0.8 percent in the first quarter. India’s GDP grew by 5.8 percent in the first quarter.

The American GDP growth was 3.1?percent in the first quarter, but it is expected to decline significantly in the second quarter. Goldman has cut the second-quarter GDP growth forecast of the U.S.?to 1.4 percent, while Bloomberg economists predict that it will shrink to about 1.8 percent. Atlanta Fed’s GDP Now model at the end of June showed that American GDP growth is expected to be 1.5 percent in the second quarter.?No matter what kind of forecast, the growth rate of China’s economy in the same period is much higher than that of the U.S., and its economic increment is also higher than that of the latter. However, Trump turned a selective blind eye to this and mocked the Chinese economy.

?

Tariffs Are A “Double-edged Sword”

It is wrong for Trump to believe that the imposed tariffs on China will be paid by China and that American consumers will not be affected.?In fact, the self-paid tariffs will also harm the interests of its consumers. It can be said that the imposition of tariffs is a typical way of doing harm to others and against oneself, and the ultimate result is bound to be a double loss.

Even Larry Kudlow, the White House economic adviser, admitted in May that the U.S. tariffs on China would increase the tax burden on U.S. companies, which would normally be passed on to their consumers.

A study released in March 2019 by economists at the Federal Reserve Bank of New York, Princeton University, and Columbia University, showed that current tariff revenues in the U.S. are insufficient to compensate for the losses suffered by consumers of imported goods.

Another study conducted at the same time by economists such as Penny Goldberg, the chief economist of the World Bank, and Pablo Fargebaum of the University of California, Los Angeles, also found that American consumers and businesses bear the cost of tariff increases. The study also pointed out that if retaliatory measures from other countries were considered, trade wars would prevail. The victims were the farmers and blue-collar workers who supported Trump in the 2016 presidential election.

Fox News reported?that, according to the current tariff situation, each family of four in the U.S. has to pay an extra $767 a year, reducing 934,700 jobs. If Trump raises taxes on China and China takes counter-measures, the cost per household will increase to $2,294 a year, and 2,159,500 jobs will be?lost. American GDP will hence drop by 1.01 percent. From this, we can see that both the Chinese economy and the U.S. economy will be affected.

The imposition of tariffs on China by the U.S. may force individual market players to transfer their production lines, but it is by no means the main factor leading to the outward transfer of foreign capital and enterprises in China.

The outward transfer of foreign capital or market entities in China is an independent behavior of enterprises, which comprehensively consider various factors. These factors include reducing costs (such as labor cost, material cost, transportation cost, supporting facilities, environmental protection cost, etc.), expanding the market scale, and seeking alternate resources. Although it also has the influence of avoiding Sino-U.S. trade frictions and being forced to impose tariffs, this is not the main reason.

According to data released by the Chinese Ministry of Commerce, in the first half of 2019, China added 20,000 foreign-funded enterprises. The actual use of foreign capital increased by 7.2 percent year-on-year, and by 8.5 percent in June. In the past three years, global cross-border investment has dropped from $1.9 trillion to $1.3 trillion.?In this world context, China’s FDI performances have been extremely outstanding,?which is not easy to achieve.

During the Second Belt and Road Forum for International Cooperation in?April, the participating countries signed a total project cooperation agreement of over $ 64 billion dollars, illustrating the firm confidence held by each of the countries in China’s economic development.

China’s Confidence to Face All risks and Challenges

China is steadily expanding its reform and opening-up.?A new version of the negative list of foreign investment access has been issued. The Foreign Investment Law will be formally implemented on January 1, 2020, and the free trade?zones?will continue to expand. Since the Shanghai Pilot Free Trade Zone, the first domestic free trade zone, was officially established in September 2013, 12 free trade zones have been established in China. President Xi Jinping announced again at the G20 Summit on June 28, 2019, that China will set up 6 new free trade zones, and add a new area for the Shanghai Pilot Free Trade Zone, thereby demonstrating China’s determination to accelerate the formation of a new situation of opening to the outside world.

The protection system of property rights has been continuously improved, the protection of intellectual property rights has been strengthened, and the market competition has been stimulated. According to the New Progress in China’s Protection of Intellectual Property Rights (2018) issued by the Office?of the National Leading Group?on the Fight against IPR Infringement and Counterfeiting on May 15, 2019, China has formulated and revised a series of laws and regulations, such as the E-Commerce Law and the Regulation on Patent Agency. In 2018, national administrative law enforcement organizations?investigated 215,000 cases of infringement and counterfeiting, and these public security organs uncovered nearly 19,000 cases of infringement and counterfeiting. Due to the increasing?protection of property rights and the continuous improvement of the business environment, innovation and entrepreneurship in?the China?market have continued?to improve, and the quality of economic development has been steadily enhanced. According to the Global Innovation Index?2019 released by the World Intellectual Property Organization, China’s innovation index ranked 14th, rising for four years.

China’s tax and fee reduction are having remarkable results, while a large room remains for fiscal and monetary policy flexibility. From the perspective of fiscal policy, according to the statistics of the Ministry of Finance, the cumulative growth rate of the national tax revenue in the first half of 2019 was 13.5 percentage points lower than that in the same period of 2018. The stimulus effect of tax cuts and fees?reduction is especially significant in such industries as manufacturing. The impact of tax cuts and fees?reduction on fiscal balance is normal and controllable. The central government has raised funds by raising deficit ratio, reducing expenditure and increasing the profit ratio of state-owned enterprises. In addition, local financial departments at all levels?may?raise funds by activating state-owned funds and assets through multiple channels, and increasing?relevant?income. This will leave ample room for fiscal policies in the second half of the year.?Against the background of the complicated international economic and financial situation and the increase of external uncertainties and instabilities, the counter-cyclical adjustment of China’s monetary policy is expected to increase. Especially in the case of the loosening turn of global monetary policy, the future flexible adjustment of monetary policy of China will have more room. Structural policy instruments such as targeted RRR cuts, targeted medium-term lending facilities (TMLF) and rediscountrate still have room to work, and the guided interest rates of monetary market policy (7-day repurchase rate, MLF interest rate, etc.) may also be lowered.

With the acceleration of industrial transformation and upgrading, investment in the high-tech manufacturing industry has increased rapidly.?The value added to the modern service industry, especially information transmission, software, and information technology services, has also increased rapidly and the industry has steadily moved up to the high end of the value chain. In the first half of 2019, manufacturing investment increased by 3.0%, and the growth rate accelerated by 0.3 percentage points. Investments in high-tech manufacturing increased by 10.4% annually, which was 4.6 percentage points faster than the total investment. Investments in the high-tech service?industry increased by 13.5%, which was 7.7 percentage points faster than the total investment. In the modern service industry, the added value?of?the?information transmission, software and information technology service?industry increased by 20.6% annually, indicating that the high-tech industry and modern service industry have become hotspots for market investment

In the face of the complex and severe situations at home and abroad, as well as many uncertainties, China has the confidence to face all risks and challenges, maintain medium- and high-speed economic growth, and achieve high-quality development.

Jia Zhongzheng, Assistant Researcher, Institute of World Economy and Politics, Chinese Academy of Social Sciences

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +